By Kevin E. Noonan —

An enduring trope in literature from all civilizations is the efforts of one generation to make conditions and prospects better for the next generation. That parents care for their children has been explained as "human nature," sound economics, or biologically determined altruism (thereby extending the lifespan of one-half of one's genes in each child). A different question is to what extent are existing members of a polity willing to sacrifice not only for their own children but for a more disembodied "posterity," particularly when the sacrifices required are related to healthcare costs in the present and the benefits are (perhaps) better healthcare in the future.

This is the question raised in a provocative paper published in Health Affairs entitled "The Benefits from Giving Makers of Conventional 'Small Molecule' Drugs Longer Exclusivity over Clinical Trial Data." The authors include Dana P. Goldman, Norman Topping Chair in Medicine and Public Policy, Director of the Leonard D. Schaeffer Center for Health and Economics, University of Southern California; Darius N. Lakdawalla, Associate Professor, School of Policy, Planning and Development, Director of Research, Leonard D. Schaeffer Center for Health and Economics, University of Southern California; Jesse D. Malkin, Consultant, Precision Health Economics, Santa Monica, CA; John Romley, Research Assistant Professor, School of Policy, Planning and Development, University of Southern California; and Tomas Philipson, Daniel Levin Professor of Public Policy Studies, Irving B. Harris Graduate School of Public Policy Studies, University of Chicago. Their conclusion: that extending "data exclusivity" for conventional "small molecule" drugs from the present 5 years under the Hatch-Waxman Act to 12 years (the term given biologic drugs under the Affordable Care Act of 2010) would provide a net benefit in new drugs and increased longevity, not for ourselves but for our grandchildren.

This is the question raised in a provocative paper published in Health Affairs entitled "The Benefits from Giving Makers of Conventional 'Small Molecule' Drugs Longer Exclusivity over Clinical Trial Data." The authors include Dana P. Goldman, Norman Topping Chair in Medicine and Public Policy, Director of the Leonard D. Schaeffer Center for Health and Economics, University of Southern California; Darius N. Lakdawalla, Associate Professor, School of Policy, Planning and Development, Director of Research, Leonard D. Schaeffer Center for Health and Economics, University of Southern California; Jesse D. Malkin, Consultant, Precision Health Economics, Santa Monica, CA; John Romley, Research Assistant Professor, School of Policy, Planning and Development, University of Southern California; and Tomas Philipson, Daniel Levin Professor of Public Policy Studies, Irving B. Harris Graduate School of Public Policy Studies, University of Chicago. Their conclusion: that extending "data exclusivity" for conventional "small molecule" drugs from the present 5 years under the Hatch-Waxman Act to 12 years (the term given biologic drugs under the Affordable Care Act of 2010) would provide a net benefit in new drugs and increased longevity, not for ourselves but for our grandchildren.

The authors note that this idea is not new: Europe gives ten years of data exclusivity for both conventional and biologic drugs, and the National Academy of Science, Committee on Science, Engineering and Public Policy recommended that the U.S. adopt the European term (National Academies Committee on Science, Engineering, and Public Policy, Institute of Medicine, "Rising Above The Gathering Storm: Energizing and Employing America for a Brighter Economic Future," Washington (DC): National Academies Press; 2007). This study also suggested that research be funded to ascertain whether ten years of data exclusivity was long enough "given the complexity and length of drug development today." The authors' thesis is that data exclusivity term length "entails a trade-off between current and future generations" because a longer term causes drug prices to rise in the short term but promotes "a stronger incentive to innovate" in innovator drug companies, which provides benefits in the future. "Although some have questioned whether profits drive innovation, empirical evidence strongly supports this relationship," the authors assert, citing the increase in pharmaceutical development after passage of the Orphan Drug Act in 1983 (Lichtenberg & Waldfogel, 2003, "Does misery love company? Evidence from pharmaceutical markets before and after the Orphan Drug Act," Cambridge (MA): National Bureau of Economic Research; 2003. NBER Working Paper No.: 9750) and stimulus of vaccine production that accompanies higher profits for vaccine-makers (Finkelstein, 2004, "Static and dynamic effects of health policy: evidence from the vaccine industry," Q J Econ. 119: 527–64). According to a study by Acemolglu and Linn published in Quarterly Journal of Economics in 2004, "a 1 percent increase in the potential market size for a drug class leads to a 3-4 percent growth in the entry [into the marketplace] of new drugs (Acemoglu & Linn, 2004, "Market size in innovation: theory and evidence from the pharmaceutical industry," Q J Econ. 119: 1049–90)." This incentive can be quantified, the authors assert, so that one additional drug would be expected to be produced for each additional $97.5 million in annual revenue. This represents a 12% return on the average $800 million investment required to bring a new drug to market.

The authors address the question of what are the effects on longer data exclusivity terms for small molecule drugs on both "present [higher drug costs] and future [more new drugs] generations." Specifically, 1) "[h]ow would extending the initial five years of data exclusivity for new conventional drugs in the United States affect innovation?" 2) "[h]ow would a longer period of data exclusivity affect the health of current and future generations?" 3) "[w}hat is the dollar value of a longer period of data exclusivity to US society?"

The authors perform their analysis by estimating the increase revenues to innovator drug companies that would accrue if the data exclusivity period was extended from 5 years to 12 years, using "retrospective data from the drugs@FDA database." These results were then analyzed in the authors "global pharmaceutical policy model" (Lakdawalla et al., 2008, "US pharmaceutical policy in a global marketplace. Health Aff. (Millwood). 28(1): w138–50) to determine "the effect of increased pharmaceutical revenues on drug innovation and consumers' longevity." The authors make some explicit assumptions: that "next year's health status depends on today's health"; that the "social discount rate" (i.e., how "society discounts benefits in the future compared with benefits today") is 3 percent; and that the "innovation elasticity" is 3.0 (i.e., that "a 1 percent increase in expected drug revenue leads to a 3 percent increase in the number of drugs approved within [a drug] class each year"). Their model also assumes that "increased innovation . . . affects population health," wherein drug innovation leads to new drugs, which leads to a greater likelihood of treatment and greater life expectancy, which results in a greater population of potential drug users, which further increases drug revenue and stimulates further innovation. Finally, while acknowledging that "[t]he monetary value of increased longevity . . . has long been a subject of debate," the authors assumed "a monetary value of increased longevity of $200,000 per life-year."

The authors also recognize limitations in their analysis, including differences between conditions existing during creation of the retrospective data and future changes in "laws, regulations, science and medicine" such as increases in successful drug patent challenges, government price controls and unforeseen advances (or setbacks) in medical science. Also not considered (due to its inherent "complexity") are changes in generic drug manufacturer behavior (such as those companies conducting independent clinical trials) or the effects of "nonmortality benefits" such as mental health or pain.

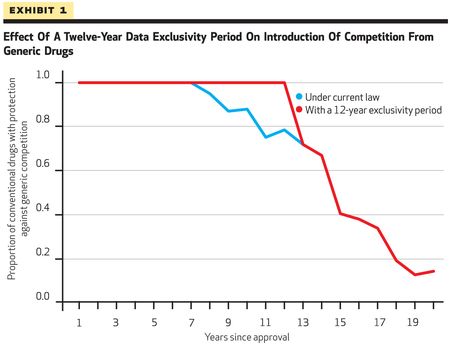

Their results show that "extending data exclusivity to twelve years would increase lifetime drug revenues by 5 percent (average)" (see Goldman et al., 2011, Exhibit 1 below; click on image to expand).

On average innovator drugs face generic competition within 8 years of FDA approval under current law, while under the authors' assumption, data exclusivity would protect such drugs for "at least twelve years after launch." As a result, the authors estimate that between 2020 and 2060 there would be 228 "extra" drug approvals, presumably the result of reinvestment in new drug development of all or a portion of the increased drug revenues (see Goldman et al., 2011, Exhibit 2 below; click on image to expand).

On average innovator drugs face generic competition within 8 years of FDA approval under current law, while under the authors' assumption, data exclusivity would protect such drugs for "at least twelve years after launch." As a result, the authors estimate that between 2020 and 2060 there would be 228 "extra" drug approvals, presumably the result of reinvestment in new drug development of all or a portion of the increased drug revenues (see Goldman et al., 2011, Exhibit 2 below; click on image to expand).

They estimate that the resulting benefits in longevity to be small (essentially zero) for Americans turning 55 in 2020, but to provide an increase in life expectancy of 1.44 years for a 55 year old in 2060 (compared to 1.3 additional years under "the status quo") (see Goldman et al., 2011, Exhibit 3 below; click on image to expand).

While this difference is small (1.7 months), it is on the order of the benefits that would accrue from eliminating obesity among Americans (2.5-13 months). However, the 55-year-olds in 2020 will "bear the cost of increased drug spending" without reaping any of the benefits; those benefits will accrue to their grandchildren forty years later. The authors compare the "cost" to the "benefits" per capita of development of new drugs resulting from an increase in the data exclusivity term from 5 to 12 years (see Goldman et al., 2011, Exhibit 4 below; click on image to expand).

While this difference is small (1.7 months), it is on the order of the benefits that would accrue from eliminating obesity among Americans (2.5-13 months). However, the 55-year-olds in 2020 will "bear the cost of increased drug spending" without reaping any of the benefits; those benefits will accrue to their grandchildren forty years later. The authors compare the "cost" to the "benefits" per capita of development of new drugs resulting from an increase in the data exclusivity term from 5 to 12 years (see Goldman et al., 2011, Exhibit 4 below; click on image to expand).

The authors conclude that "[t]his finding is robust with respect to plausible assumptions about the effect of revenues on innovation and other factors," while conceding that "there is uncertainty regarding potential changes in regulations, science, and medicine that were not incorporated into our model." Some of the authors' assumptions may be unreasonable — for example, the inherent unpredictability of innovator drug research (which is properly used to justify exclusivity in the first place) make their estimate of 228 "extra" new drugs being developed between 2020 and 2060 to be inherently suspect, and just the type of "prediction" that results from economic analysis (which makes fundamental assumptions of the effects of demand on the reality of supply). However, the benefit of this study is that it provides analytical evidence that, perhaps counter-intuitively, prolonging the term that an innovator can recoup financial regards for innovation can lead to additional innovation. Perhaps this is not so counter-intuitive when certain facts are taken into consideration. First, that the cost of drug development has skyrocketed over the 25 years since the Hatch-Waxman Act was passed. Second, that innovation has become more difficult over that period, as argued by Richard Epstein in his book Overdose: How Excessive Government Regulation Stifles Pharmaceutical Innovation, since the "low-hanging fruit" of antibiotics and other drugs have been developed and drugs for diseases like diabetes are inherently more difficult to find and produce. Third, that the economics of drug development (affected in part by the Hatch-Waxman regime) discourages development of new drugs and encourages analogues, enantiomers and novel formulations of already-developed drugs. And other researchers have elucidated the unexpected consequences of the Hatch-Waxman Act, which encourages nothing so much as ANDA litigation (draining resources from further drug development) (see "Maybe Hatch-Waxman Data Exclusivity Isn't So Good For Traditional Drugs After All").

The authors conclude that "[t]his finding is robust with respect to plausible assumptions about the effect of revenues on innovation and other factors," while conceding that "there is uncertainty regarding potential changes in regulations, science, and medicine that were not incorporated into our model." Some of the authors' assumptions may be unreasonable — for example, the inherent unpredictability of innovator drug research (which is properly used to justify exclusivity in the first place) make their estimate of 228 "extra" new drugs being developed between 2020 and 2060 to be inherently suspect, and just the type of "prediction" that results from economic analysis (which makes fundamental assumptions of the effects of demand on the reality of supply). However, the benefit of this study is that it provides analytical evidence that, perhaps counter-intuitively, prolonging the term that an innovator can recoup financial regards for innovation can lead to additional innovation. Perhaps this is not so counter-intuitive when certain facts are taken into consideration. First, that the cost of drug development has skyrocketed over the 25 years since the Hatch-Waxman Act was passed. Second, that innovation has become more difficult over that period, as argued by Richard Epstein in his book Overdose: How Excessive Government Regulation Stifles Pharmaceutical Innovation, since the "low-hanging fruit" of antibiotics and other drugs have been developed and drugs for diseases like diabetes are inherently more difficult to find and produce. Third, that the economics of drug development (affected in part by the Hatch-Waxman regime) discourages development of new drugs and encourages analogues, enantiomers and novel formulations of already-developed drugs. And other researchers have elucidated the unexpected consequences of the Hatch-Waxman Act, which encourages nothing so much as ANDA litigation (draining resources from further drug development) (see "Maybe Hatch-Waxman Data Exclusivity Isn't So Good For Traditional Drugs After All").

However, this study has the benefits of being the result of peer-reviewed research, and thus subject to challenge, refutation, or affirmation by other academic researchers. In an area rife with polemic and interest-group rhetoric, such a study is a welcome oasis of rationality.

Leave a reply to max hensley Cancel reply