By Kevin E. Noonan —

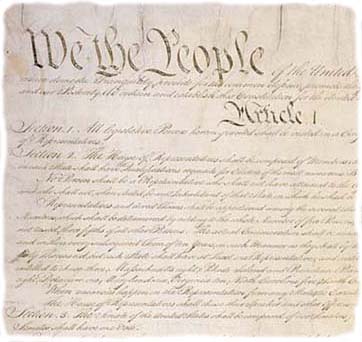

Congress has the power, under Article I of the U.S. Constitution, to grant patents "to promote the progress of Science and the Useful Arts." The value of patenting to the public is disclosure –- the raw material that drives progress is full disclosure of an invention in a patent specification that satisfies 35 U.S.C. § 112, 1st paragraph. In this way, the public will be able to practice the invention throughout its full scope once the patentee's exclusionary power has expired (a maximum term of 20 years from filing, with shorter terms for patents that expire 4, 8, or 12 years after grant for failure to pay maintenance fees).

But for patentees, and their assignees, the value of patents is to spur investment, so that the invention can be commercialized and the exclusionary grant can have economic value. This value has always been one of the drivers of commercial biotechnology, from the first nascent biotechnology companies in the early 1980s, some of which survived (Amgen and Genentech) and some of which did not (Biotechnica International and Genetics Institute).

This value is likely to come to the fore once again if the prognostications of Stephanie Marrus, writing in the latest issue of The Scientist, are true (see "How to save biotech: What the industry needs is not a bailout, but some sensible policies"; free registration required). As Ms. Marrus says in the first sentence of her piece, "[b]iotech is in trouble, again." The evidence: about one third of the 370 U.S. public biotechnology companies have less than six months in cash to support operating expenses, according to the Biotechnology Industry Organization. This is a 90% increase in the number of companies that were this cash-strapped two years ago. In addition, BIO estimates that 40% of private biotechnology companies have less than one-year's worth in cash requirements.

Part of the problem, of course, is that the source of investment for many biotechnology companies –- venture capitalists –- have more important things, like their own survival, to worry about, and as a result they have been either "hoarding cash or closing their doors," according to Ms. Marrus. Moreover, Big Pharma has become sophisticated enough, and as affected by the poor economy and their own pipeline and other woes (see "Predictions Dire for U.S. Pharmaceutical Industry," August 8, 2008) to be more discriminating in their acquisitions. The result, as noted by Ms. Marrus, is that "the companies that most need to be saved are the least likely to be bought." And the expected consequences of this situation are bankruptcies, layoffs of research personnel, cancellations of clinical trials, and "sell outs."

Under these circumstances, Ms. Marrus has the following suggestions for intervention:

• "Price controls: Do not make the mistake of interfering with free market pricing mechanisms. If a drug is overpriced relative to its efficacy, it will not sell. Setting a ceiling or instituting other price controls will only serve to insure that new drugs are not developed. Industry must see an economic return to invest in highly risky drug development or it will opt out."

• "Intellectual property: Intellectual property protection is the lifeblood of the industry, and the reason investors will fund companies without revenue. Set policies to enhance and extend protection, not dilute it. Do not weaken the predictability, value and enforceability of patents such as provisions of the Patent Reform Act of 2007, which made it through the House but thankfully stalled in the Senate last year."

• "Funding sources: Increase NIH funding so that fledgling companies have a pre-venture capital source of funds. [NOTE: NIH will receive $10 billion from the economic stimulus bill signed into law by President Obama earlier today.] NIH funding has remained stagnant for a number of years as costs continue to rise. Consider the national venture capital fund model used in other countries to provide financing during the "Valley of Death," the period when companies are engaged in translational research to bridge academe to industry and not yet fundable by venture capital."

These are all in lieu of a financial bailout which is not forthcoming (although Ms. Marrus remarks that companies involved in developing lifesaving drugs are just as deserving as Detroit automakers or other proposed recipients). Reasons for this, according to Ms. Marrus, are that many biotechnology companies do not have sufficiently-developed commercial goals or products to attract anything but speculative investment (she calls these companies little more than "science projects"). And while there may be creative ways for such companies to identify merger partners with complementary technologies, Ms. Marrus contends that management has "a vested interest in keeping their company intact to the detriment of their shareholders" and gets in the way of sound(er) business practices. "Some companies should continue life only as part of a merged entity. Some companies should sell their assets. Other companies may have to bite the bullet and shut their doors. Management needs to act responsibly for the shareholders even if it means their jobs will end," she writes.

Biotechnology is considered to be the future because it is believed to be the engine that will drive future new drug development as well as a better understanding of the molecular basis of disease. It is commonly understood by ecologists and evolutionary biologists that extinction of a species may have the consequence that some unappreciated property or beneficial product will be unavailable in future, perhaps to the detriment of humans and, more broadly, the planet. It is also recognized that sometimes in nature extinction occurs by chance, that is by (relatively) short-term perturbations of climate or other variables that the species cannot survive. It would be tragic if the current economic disruptions "killed off" a company with the combination of researchers, technology and management that could provide a future life-saving drug because we did not have the foresight to provide the conditions in which it could endure.

Leave a comment